Checking Accounts

Safe. Secure. Simple. Seamless.

Experience secure banking with your checking account whenever and wherever. With the combination of modern tools and convenience, Field & Main Bank offers unique checking solutions for all financial lifestyles. Whether you’re looking for free checking or interest checking, we have designed a tool to help you craft the right fit for you.

All Checking Accounts Feature:

- Free Debit Card

- Free Online Banking

- Free Bill Pay

- Free Mobile Banking with Mobile Deposit

- Free eStatements with online check images

- Buy back of your unused checks and debit cards from another financial institution

- Refunds on ATM fees, up to $10 monthly*

Simply Free Checking

A FREE account for everyone

- FREE debit card

- FREE first order of checks

- FREE online banking, eStatements and mobile banking with mobile deposit

- FREE bill pay

- No monthly service charge

- No minimum balance

Direct Interest Checking

Earn interest with the convenience of direct deposit or any automatic payment

- $25 minimum initial deposit

- Free first order of checks

- Competitive interest

- No minimum balance

- No monthly service charge

50+ Interest Checking

A perfect account for customers 50 and over

- $25 minimum initial deposit

- Free standard checks

- Competitive interest

- No minimum balance

- No monthly service charge

Premium Interest Checking

An account for those interested in higher interest

- $25 minimum initial deposit

- Free standard checks

- Higher interest rate with a balance of $1,500 or more

- Competitive interest if balance falls below $1,500

- Only $6 monthly charge if minimum balance falls below $1,500¹

Wellness Checking

Your health in good hands

Your Wellness Checking account functions like an investment account for your healthcare expenses. By setting aside money in this account, you’ll be prepared for any medical needs that arise.

- No minimum initial deposit

- Debit Card

- Interest bearing

*This account does not feature ATM rebates.

Choose the Right Account

Our account selector tool will help you craft the right fit

- Three simple questions

- Open account immediately or in a banking center

Minimum opening deposit for all accounts with the exception of Wellness Checking is $25. Ask us for details. Bank rules and regulations apply. Other fees such as non-sufficient funds, overdraft fees, etc. may apply. See fee schedule for details. Up to $10 for checks and debit cards from another financial institution given at the time the checks/debit cards are presented. Buyback offer valid on new checking accounts only.

¹In the event of insufficient funds at the end of a statement cycle, the monthly maintenance fee will still be assessed; however, the account will not incur an overdraft fee.

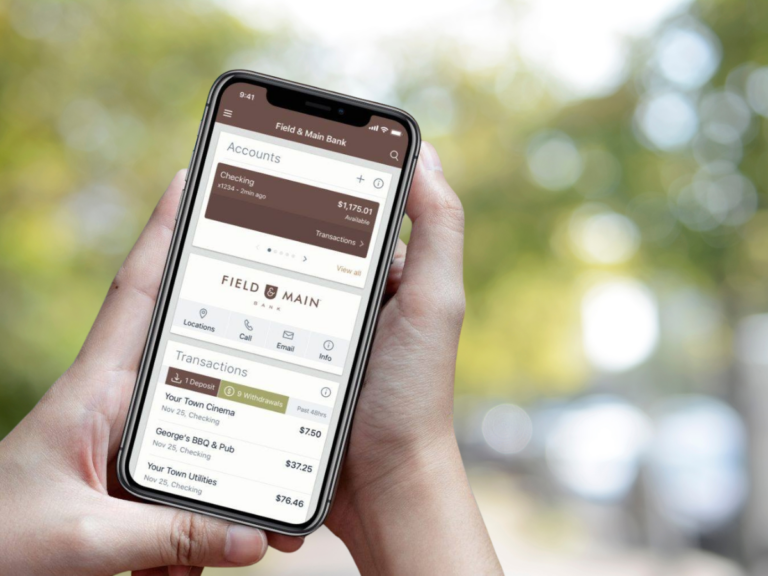

Banking Made Simple: Anytime, Anywhere with Online and Mobile Banking

Enroll in online banking and download our mobile app to monitor your accounts, pay bills, deposit checks remotely, move money and more – whenever you want from virtually anywhere.

Checking Account FAQs

Have questions? We’re here to make banking simple. From opening your account to using your debit card or setting up direct deposit, our FAQs cover the details you need to get started with confidence.

How much money do I have to put in the account to open it?

When you open a new checking account, you’ll need to make an initial deposit of $25.

How long does it take to get a debit card? How much do debit cards cost?

Every checking account comes with a free debit card. We offer Instant Issue debit cards, so you can leave any of our banking centers with your card in hand within minutes. In some cases, it may take up to 2 business days for the card to fully activate and be ready to use.

Do you have a free checking account?

Yes! In fact, we have several free accounts. You can give us a call at (888) 831-1500 or send us an email. We’ll ask you a few simple questions to see which one best suits your needs!

Can I deposit a check with my phone or tablet?

Yes, you can. All our checking accounts feature free mobile deposit. You can deposit checks with your phone or tablet using our mobile app. Learn more about mobile banking and remote deposit here.

Do I have to pay for my statements?

No, you don’t. We offer e-statements which you can access anytime through online banking. Each month, you’ll receive an email notification when your statement is ready. We also provide free paper statements which are mailed to you monthly. However, we recommend e-statements, as they are more secure than paper statements.

How do I set up direct deposit for my account?

We have a simple Direct Deposit form that you can complete and take to your employer. In some cases, your employer may have their own form that they require you to complete. If they need verification of your account number and routing number, we can easily provide that for you as well.

Give us a call at 1-888-831-1500 or email us and we would be happy to help you.

Need More Info?

Digital Banking

Access your accounts securely from anywhere, check balances, transfer funds, and pay bills—all from your smartphone or computer.

Savings Accounts

Whether you’re saving for big purchases or emergencies, depositing both your money and confidence in a Field & Main savings account is easy.